Investing During Covid-19, Downgrades & Rand Depreciation

We as your investment platform and you as our valued client, are together experiencing an unprecedented time in our joint investment journey. As you are undoubtedly being inundated with information, I will keep this letter, addressing the three matters above, as concise and to the point as I can.

Operational fitness

We recently communicated with you that our business took certain measures to comply with the parameters set by the authorities with respect to the Covid-19 lock-down. I am happy to report that we are operating normally and at close to full capacity whilst fully adhering to the restrictions of the lock-down.

Downgrade

The decision by Moody’s to downgrade South Africa’s sovereign rating to below investment grade was not unexpected. Its timing, however, is most unwelcome and puts additional pressure on the country’s economy during an already precarious time. The message here again is quite clear. Caution should be exercised in overreacting to the multiple events we find ourselves faced with. Investment success is largely achieved by keeping calm, practising investment discipline and not losing sight of your long-term investment goals. Remain invested for the recovery and the long term.

Investment performance

While markets and currencies are in turmoil, I can assure you that we have the smartest minds working through the challenges facing us as a result of the convergence of a global pandemic, an investment downgrade and a currency that continuously comes under fire as a consequence of South Africa’s complex economic situation.

Exchange Traded Products

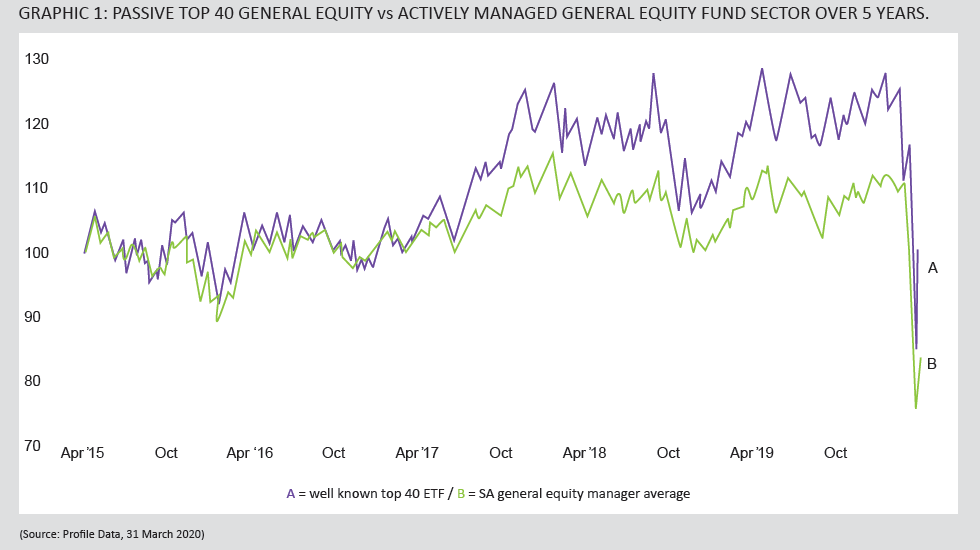

Exchange traded products such as ETFs have been criticised for many years as being more volatile than managed funds that are supposed to have handbrakes to prevent excessive losses. We have certainly not seen this handbrake. Consider the graphics below in which I have purposefully used only five-year terms to demonstrate a fair slice of a market cycle.

Graphic 1 reflects how the average of all general equity fund managers performed (after fund costs) against the Top 40 index (considered to be a general equity measure) over the last five years with an investment of R100. I have used a well-known Top 40 ETF as a measure against the average of active general equity fund managers. The ETF would have returned R98.62 and the average of all general equity managers would have returned R83.96. It’s a myth that general equity ETFs (and ETFs in general) are more volatile than general equity funds as is so often alleged.

As Warren Buffett quipped so aptly: Only when the tide goes out do you discover who’s been swimming naked.

Balanced Funds

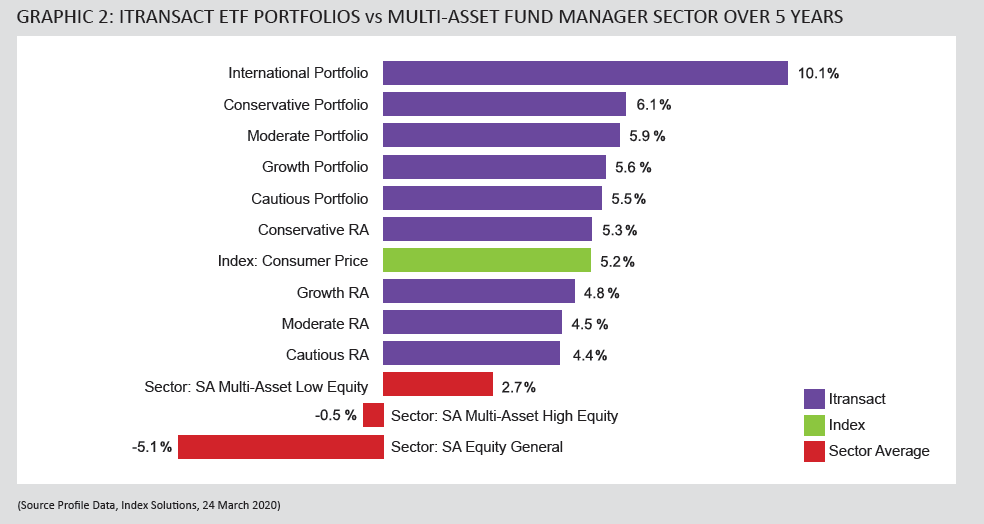

Graphic 2 suggests, in a similar way, that asset allocation investment strategies involving multiple ETFs representing cash, reals estate, fixed income and equity, have also been unfairly criticised and I wish to dispel this myth too. In this example I’m intentionally measuring Itransact’s range of ETF portfolios, more specifically our moderate (balanced) portfolios, against the average of the active multi-asset fund managers.

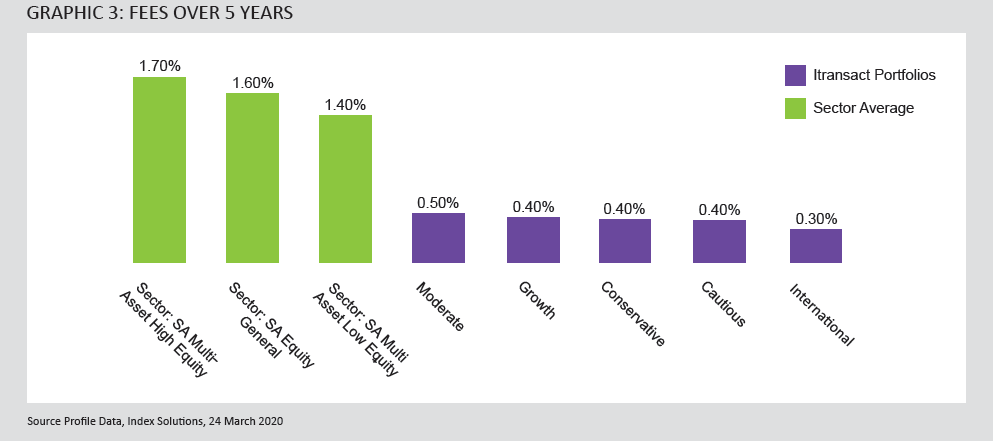

Costs

High investment costs destroy returns. Graphic 3 demonstrates the remarkable difference in costs of products related to those in graphic 2.

Conclusion

Itransact has been a pioneer in the establishment of the most efficient ways to invest in and profit from ETFs. As we celebrate our platform’s 8th birthday (and our holding company’s 23rd!) we would like to take this opportunity to wish you and your loved ones well during the times ahead, while we as a business, take good care of your investments.

Please visit Performance to view our latest managed portfolio returns as well as other products such as single fund ETFs

Regards

Lance Solms

Director: Retail Product Distribution

PS: I thought I would remind us all of how Warren Buffet views markets in crisis. “The stock market is designed to transfer money from the impatient to the patient.”