How to build a winning share portfolio for your clients

Investors requires three key ingredients for successful investing.

- Money

- Time

- Knowledge

Money and time is the easy part. Lack of investment knowledge is the part that confounds investors. Luckily, financial advisors can easily provide this part.

Using Exchange Traded Funds (ETFs) is one of the smartest ways to build a winning share portfolio. ETFs are unit trust funds which are listed on a stock market just like a share. ETFs focus on tracking the performance of the best companies so that you don’t have too.

A simple three step approach to building an effective ETF portfolio.

Step 1: Choosing ETFs

Vanilla ETFs (as opposed to ETFs with built in strategies) work best. The reason is simple, it’s like baking a cake. Using simple fresh, high quality ingredients result in better cakes made from instant cake mixes which contain different and complex ingredients and additives.

ETFs which already contain complex and expensive mechanisms that attempt to beat the market (and sometimes don’t) cost more and by blending them one also runs the risk of introducing strategies that clash.

Vanilla ETFs are also able to tolerate the failure of a stock or two without harming the overall performance of the ETF and because they are vanilla, they are predictable, making it easier to extract their value in a well-controlled manner.

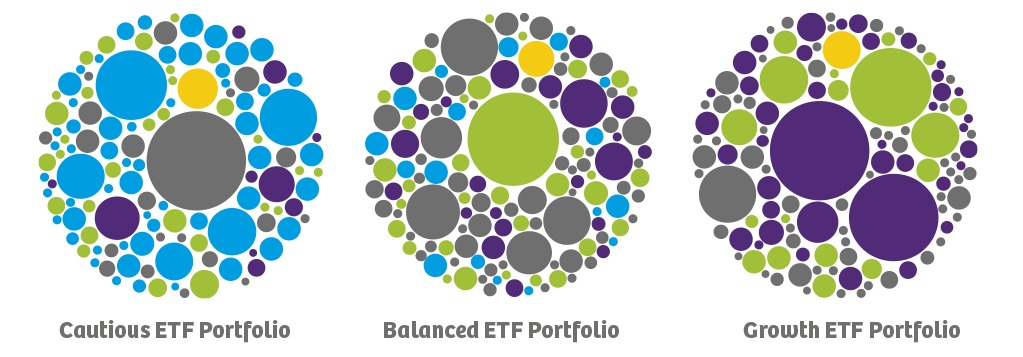

Step 2: Asset Allocation

Choosing the correct “baskets” (money market, bonds property and equity) is important to ensure a portfolio is well diversified.

Choose the most efficient vanilla ETF that represents each asset class. These ETFs must be the most efficient ETF from each asset class meaning it must be the lowest risk, highest return ETF that represents each basket.

You should now have four to five ETFs in what called a model portfolio to which you can apply risk selection too.

Step 3: Risk

This is where time comes in and you will need to “tilt” your model portfolio in a particular direction.

Conservative 1-3 year

Mostly money market and bonds with a small proportion of global equity for a slight kicker

Cautious 3-6 years

Mostly bonds, low proportions of local money market, property and global equity

Moderate 6-8 years

Equal doses of money market, bonds, property and equity

Growth 8-11 years

Mostly local and global equities with little or no money market, property and bonds

Aggressive 11+ years

100% local and global equities

Investment platforms like Itransact are experts in assisting advisers building effective ETF portfolios for their clients and have a strong track record of delivering robust returns.

Itransact has already done the work for you and offers a range of 10 pre-packaged, risk adjusted savings retirement portfolios which you can immediately deploy into your client base.

Contact Itransact on 0861 468 383 for more information